E-Commerce Logistics Set to Surge in 2025 Despite Policy Pressures, Says Ti Insight

By Maria Kalamatas | The Logistic News | April 2, 2025

The global e-commerce and e-fulfilment market is set to expand by 15.5% in 2025, according to the latest research from Ti Insight, affirming that consumer appetite for online shopping continues to drive logistics growth—even amid growing regulatory scrutiny over cross-border trade.

After a brief post-pandemic contraction in 2022, the market is once again accelerating at a brisk pace. In 2024, the sector was valued at €521.9 billion ($569 billion), marking a 13.6% year-on-year increase and nearly doubling its 2019 pre-pandemic size.

Digital Retail Momentum Remains Strong

Paul Chapman, Senior Editor at Ti, described the current trajectory as a clear sign of digital retail’s permanent transformation.

“The continued growth in the e-commerce logistics and e-fulfilment sector highlights the ongoing expansion of e-commerce within global retail,” Chapman said. “We are now witnessing a significant differentiation between providers of e-commerce logistics and e-fulfilment players across continents, as they adapt to the delivery requirements of retailers and customers.”

Drivers of this renewed momentum include economic stabilization in key markets, improvements in digital infrastructure, and a deeply embedded shift in consumer purchasing habits—many of which were forged during the peak of the COVID-19 pandemic and have since solidified into long-term trends.

Cross-Border Policy Uncertainty Looms

This optimism comes even as governments, especially in the U.S., increase scrutiny of small-parcel imports. The “de minimis” exemption—currently allowing duty-free entry of packages under $800—has come under political fire for allegedly undermining domestic trade and enabling tariff avoidance.

Earlier this year, the U.S. government attempted to revoke this exemption, only to reverse course within days due to customs infrastructure being overwhelmed. However, plans to reintroduce stricter measures remain in motion, with upgraded systems being developed to handle increased volume.

Despite such policy fluctuations, Ti Insight maintains that e-commerce growth remains resilient.

“Although President Trump’s policies on trade and tariffs have introduced significant uncertainty into the market, the sector shows no signs of being blown off course,” the report states. “Consumer habits have transformed, and this will power domestic and cross-border e-commerce and e-fulfilment needs for years to come.”

Asia Pacific Closing the Gap

Regionally, the Asia Pacific market continues to grow at a faster clip than its Western counterparts. Since 2020, the region has seen growth of 11%, outpacing North America (10%) and Europe (8%). While North America still holds the largest overall share, the margin separating it from Asia Pacific is narrowing each year.

This shift underscores the increasing role of emerging e-commerce powerhouses in countries like China, India, and Southeast Asia, where digital marketplaces are seeing accelerated adoption and investment.

M&A Activity Accelerates in Logistics

The report also highlights a flurry of merger and acquisition activity, as established logistics giants look to expand their e-commerce reach by absorbing smaller, specialized players.

Notable moves include:

- DHL acquiring Inmar Supply Chain Solutions and Brandpath Group

- Stord purchasing Pitney Bowes’ fulfilment operations

- GLS taking over e-Log

- Bpost acquiring Staci

These strategic consolidations reflect a growing consensus in the industry: e-commerce is no longer a niche vertical—it is the backbone of modern logistics.

A Decade of Disruption—and Opportunity

The Ti Insight report frames 2025 as a year of both challenge and opportunity. Regulatory frameworks are becoming more complex, and geopolitical tensions may intermittently disrupt supply chains. But overall, the demand for fast, transparent, and reliable delivery services continues to soar.

As e-commerce logistics matures, differentiation through technology, fulfilment speed, and geographic reach will determine who leads in the next phase of global trade. For now, the numbers point to a clear conclusion: the digital consumer economy is only just beginning its next chapter.

Maria Kalamatas is Senior Logistics Correspondent at The Logistic News, covering global trends in digital commerce, supply chain strategy, and cross-border trade.

The post E-Commerce Logistics Set to Surge in 2025 Despite Policy Pressures, Says Ti Insight appeared first on The Logistic News.

Share this post

Related

Posts

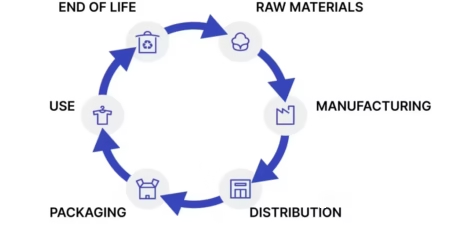

Decathlon Introduces Circular Logistics Model to Cut Emissions and Waste

LILLE – July 2, 2025The French sporting goods retailer Decathlon has officially launched a new circular logistics program aimed at...

Kenya’s Lamu Corridor Moves Into the Spotlight as Cargo Shifts North

NAIROBI – July 2, 2025After years of skepticism and political delays, Kenya’s LAPSSET Corridor is finally beginning to show real...

Germany Commits €4 Billion to Rail Freight Modernization Amid Growing Delays

BERLIN — July 2, 2025 “Germany cannot afford to let its logistics backbone crumble. Rail is not just infrastructure — it’s...

Air Cargo Peaks in Saudi Arabia as Pilgrims Begin Post-Hajj Departures

JEDDAH – July 2, 2025As millions of Hajj pilgrims prepare to return home this week, Saudi Arabia’s air freight sector...