Stellantis Reports a Strong Quarter but Keeps Its Guard Up Over U.S. Tariffs

The morning began with good news for Stellantis — revenue for the third quarter reached €37.2 billion, a rise of around 13 percent from the same period last year. That’s a welcome change after several uneven quarters marked by component shortages and a shaky retail environment.

Still, no one inside the group is celebrating too loudly. While the numbers look encouraging, executives know that the global trade backdrop is shifting once again. New U.S. import tariffs are eating into margins on several models built in Europe and shipped across the Atlantic. Stellantis now estimates the impact at roughly €1 billion, down from earlier fears but still large enough to change the tone of its forecasts.

Instead of accelerating output, the company is focusing on precision — smaller production batches, better control of inventories, and more coordination between plants and logistics teams. One senior manager described the approach as “measured speed,” meaning the company wants to protect volume without getting caught in another cost spiral.

In practical terms, that means fewer big ocean shipments and more segmented delivery plans to match specific regional demand. Freight planners working with Stellantis say the group has shifted from “ship it all” to “ship what sells,” with dedicated space only for confirmed dealer orders.

The firm is also preparing to invest $13 billion in new U.S. capacity over the next few years to reduce exposure to tariffs and freight volatility. Part of that funding will go toward adapting assembly lines for hybrid and electric models already performing well in Europe.

For logistics partners, this pivot changes the game. There will be less volume chasing and more contractual predictability, especially on trans-Atlantic lanes. Shipping slots will tighten, but the long-term relationships with carriers that offer stable service will gain new weight.

So yes, Stellantis is growing again — but in 2025, growth comes with conditions. It’s not about scale for its own sake; it’s about control, cost, and making sure every vehicle that leaves port earns its journey.

The post Stellantis Reports a Strong Quarter but Keeps Its Guard Up Over U.S. Tariffs appeared first on The Logistic News.

Share this post

Related

Posts

The United States seizes a 7th tanker: pressure mounts on sanctioned ships

New episode in the maritime tug-of-war over sanctions: the United States has seized a seventh tanker suspected of operating in...

China replaces US barrels with Canada: new impact on tanker routes

The geography of oil is shifting, and shipping feels it immediately. According to analyzes reported by BIMCO, Chinese crude oil...

The Port of Klaipėda Signs a Record Year Driven by Containers, LNG, and Ro-Ro

The Lithuanian port of Klaipėda announces a historic performance in 2025: 39 million tons handled, despite a tense geopolitical context...

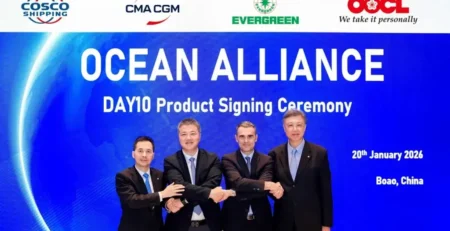

Ocean Alliance maintains the detour via the Cape, while preparing a “Suez plan”

The Ocean Alliance (CMA CGM, COSCO Shipping, Evergreen, and OOCL) has just unveiled its “Day 10” East-West network, which will...