Pennsylvania PSERS Commits €75M to Realterm’s European Logistics Fund as Global Infrastructure Bets Expand

Pennsylvania PSERS Commits €75M to Realterm’s European Logistics Fund as Global Infrastructure Bets Expand

By Maria Kalamatas | March 25, 2025 | The Logistic News

The Pennsylvania Public School Employees’ Retirement System (PSERS) has committed €75 million to the Realterm Europe Logistics Fund II, underscoring the pension fund’s growing confidence in value-add logistics infrastructure across Europe.

According to a board meeting document, the fund commitment forms part of Realterm’s broader strategy to raise €400 million, with a €500 million hard cap. Realterm itself is contributing €7.5 million as a general partner commitment. The strategy targets net internal rates of return (IRR) of 13% to 15%, focusing on value-add industrial and logistics assets across key European markets.

So far, Fund II has raised €374 million, according to investment consultant Aksia, and has already deployed approximately €17 million into two logistics properties in the Netherlands—highlighting early traction in strategic European freight corridors.

The commitment reflects a broader institutional pivot toward logistics and infrastructure assets that are seen as resilient amid shifting global supply chains, e-commerce growth, and ongoing urbanization.

In a parallel move, PSERS has also committed $200 million (€185.1 million) to the I Squared Global Infrastructure Fund IV, which is seeking to raise $15 billion in capital. Infrastructure manager I Squared will contribute a 2% co-investment as part of the fund’s alignment strategy.

Further diversifying its portfolio, the pension fund committed an additional $150 million to the I Squared Global Infrastructure Credit Fund II, a vehicle targeting net levered returns between 13% and 16%. Credit Fund II will provide debt capital across infrastructure development areas including construction, acquisitions, refinancing, and recapitalisation.

Together, these moves signal PSERS’ robust push into real assets, with a particular emphasis on logistics, transport infrastructure, and income-generating industrial assets that support global trade and mobility.

As freight infrastructure continues to evolve—driven by automation, sustainability goals, and nearshoring trends—logistics-focused funds like Realterm’s are increasingly viewed as strategic investment vehicles offering stable, inflation-hedged returns.

With capital flowing into both equity and credit arms of global infrastructure, PSERS is positioning itself to benefit from both short- and long-term transformations in global logistics and supply chain ecosystems.

The post Pennsylvania PSERS Commits €75M to Realterm’s European Logistics Fund as Global Infrastructure Bets Expand appeared first on The Logistic News.

Share this post

Related

Posts

The United States seizes a 7th tanker: pressure mounts on sanctioned ships

New episode in the maritime tug-of-war over sanctions: the United States has seized a seventh tanker suspected of operating in...

China replaces US barrels with Canada: new impact on tanker routes

The geography of oil is shifting, and shipping feels it immediately. According to analyzes reported by BIMCO, Chinese crude oil...

The Port of Klaipėda Signs a Record Year Driven by Containers, LNG, and Ro-Ro

The Lithuanian port of Klaipėda announces a historic performance in 2025: 39 million tons handled, despite a tense geopolitical context...

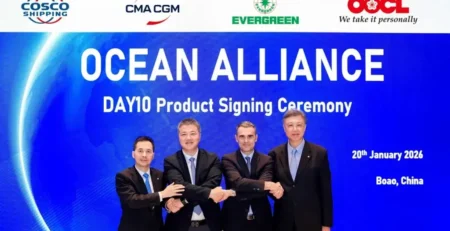

Ocean Alliance maintains the detour via the Cape, while preparing a “Suez plan”

The Ocean Alliance (CMA CGM, COSCO Shipping, Evergreen, and OOCL) has just unveiled its “Day 10” East-West network, which will...