Offshore Wind U-Turn Leaves U.S. Shipyards and Ports in the Lurch

Until a few months ago, shipyards along the U.S. coastline were humming with optimism. Welders were busy shaping hulls for turbine installation vessels, and ports from Virginia to Massachusetts were clearing space to handle blades the size of airplanes. That confidence has evaporated almost overnight.

The federal government’s decision to roll back its backing for offshore wind projects has set off a chain reaction. Contracts are being paused, some outright canceled. Yard owners talk about unfinished keels, equipment lying idle, and workers sent home earlier than expected. The sector, which had finally begun to look like a stable business after years of promises, is again facing uncertainty.

At a mid-sized yard in Louisiana, a manager described walking the docks in silence. “We had materials ready for two new vessels. Now they’re just sitting there,” he said. He doesn’t blame the clients—they’re waiting to see where policy lands—but the loss of momentum, he added, “hurts everyone down the line.”

The same hesitation is spreading northward. On the East Coast, ports that had planned multimillion-dollar expansions are suddenly hitting the brakes. One project near Norfolk that was meant to strengthen quays for heavy turbine parts has been postponed indefinitely. Local suppliers, who had stocked up on components and cranes, are now struggling to cover their costs.

The logistics industry, which had been gearing up to handle a decade of offshore cargo, is also feeling the chill. Companies that invested in cable-laying ships, specialized lifting gear, and new supply routes say business inquiries have slowed. “We built an entire service line around offshore wind,” said an executive from a heavy-lift operator. “Now we’re looking at Europe and Asia to keep our teams busy.”

Those regions, still expanding their wind capacity, are attracting the attention of American firms who don’t want to wait out Washington’s policy swings. For some, relocating part of their operations abroad might be the only way to keep their skilled crews employed.

Behind the numbers and political talk, there’s a human story. Communities that had pinned their hopes on green energy jobs are once again stuck waiting. Welders, crane operators, engineers—people who saw offshore wind as a fresh start after years of downturn in oil and gas—now face another pause.

Whether this shift is temporary or marks a deeper retreat from offshore energy isn’t yet clear. What’s certain is that ports and shipyards, the backbone of the U.S. maritime economy, are left balancing between optimism and disappointment, unsure when—or if—the wind will turn back in their favor.

The post Offshore Wind U-Turn Leaves U.S. Shipyards and Ports in the Lurch appeared first on The Logistic News.

Share this post

Related

Posts

The United States seizes a 7th tanker: pressure mounts on sanctioned ships

New episode in the maritime tug-of-war over sanctions: the United States has seized a seventh tanker suspected of operating in...

China replaces US barrels with Canada: new impact on tanker routes

The geography of oil is shifting, and shipping feels it immediately. According to analyzes reported by BIMCO, Chinese crude oil...

The Port of Klaipėda Signs a Record Year Driven by Containers, LNG, and Ro-Ro

The Lithuanian port of Klaipėda announces a historic performance in 2025: 39 million tons handled, despite a tense geopolitical context...

Ocean Alliance maintains the detour via the Cape, while preparing a “Suez plan”

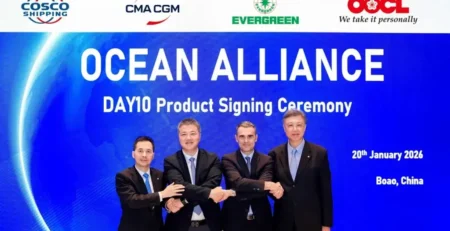

The Ocean Alliance (CMA CGM, COSCO Shipping, Evergreen, and OOCL) has just unveiled its “Day 10” East-West network, which will...