New quarterly barometer: U.S. Bank and DAT launch a report dedicated to truck rates (spot, contract, and fuel)

A new data appointment is coming to the North American market: U.S. Bank and DAT Freight & Analytics announce the launch of a quarterly report dedicated to trucking rates. Objective: To provide a structured reading of contract, spot, and fuel surcharge prices, in order to better manage transport purchases, budgets, and hedging strategies.

The first edition (Q1 2026), based on the last months of 2025, describes a market less spectacular than it seems: relatively stable contract rates, a more mobile spot, and volatility fueling that can significantly alter the final cost per mile. The cited figures notably indicate spot variations between .62/mile at the end of September, .67/mile at the end of October, and then .65/mile at the end of November. On the contract side, the levels fluctuate around .99–2.02/mile during the period.

The key point is not just the average, but the market structure. The report emphasizes a fundamental trend: the reduction in capacity (carrier exits, regulatory constraints, rising operating costs). As long as demand remains weak, the impact is contained; but if volumes pick up again, the ground is ready for rapid increases.

Message to shippers: diversify partners, test the robustness of routing guides, monitor the spot vs contract dynamics, and stay attentive to external factors (regulation, trade, international). In other words: in 2026, the advantage will not only come from “negotiating cheaper,” but from securing capacity and service continuity at the right time.

The post New quarterly barometer: U.S. Bank and DAT launch a report dedicated to truck rates (spot, contract, and fuel) appeared first on The Logistic News.

Share this post

Related

Posts

The United States seizes a 7th tanker: pressure mounts on sanctioned ships

New episode in the maritime tug-of-war over sanctions: the United States has seized a seventh tanker suspected of operating in...

China replaces US barrels with Canada: new impact on tanker routes

The geography of oil is shifting, and shipping feels it immediately. According to analyzes reported by BIMCO, Chinese crude oil...

The Port of Klaipėda Signs a Record Year Driven by Containers, LNG, and Ro-Ro

The Lithuanian port of Klaipėda announces a historic performance in 2025: 39 million tons handled, despite a tense geopolitical context...

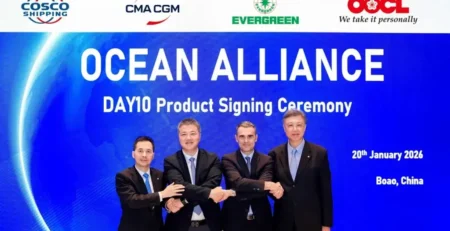

Ocean Alliance maintains the detour via the Cape, while preparing a “Suez plan”

The Ocean Alliance (CMA CGM, COSCO Shipping, Evergreen, and OOCL) has just unveiled its “Day 10” East-West network, which will...