LNG Market Braces for 2026 Supply Surge — Prices May Have to Fall

The global liquefied natural gas (LNG) market is heading into a capacity boom that could reshape pricing through 2026. Analysts at Kpler estimate that global LNG output will climb to about 475 million tonnes next year — roughly a 10 percent jump from 2025 — as major new trains in the United States, Qatar, and Mozambique come online.

So much fresh supply, the analysts warn, may require spot prices to soften to clear the additional cargoes. Forward prices in Asia and Europe are already easing from late-summer peaks, suggesting that buyers expect looser balances once the new projects reach full production.

“The supply wave is real, and the market will need lower prices to digest it,” a Kpler senior analyst told Reuters. “We’re moving from scarcity to abundance faster than expected.”

For shippers and charterers, the shift carries mixed consequences. More cargoes mean longer voyage legs and higher ton-mile demand, which supports freight activity. Yet wider vessel availability could pressure charter rates, especially for older tonnage. Traders also see the possibility of renewed arbitrage flows between the Atlantic and Pacific basins if regional spreads narrow less than feared.

Energy planners note that while the additional capacity strengthens supply security after years of volatility, it could also slow investment in emerging LNG terminals. Several buyers in South Asia and Africa are re-evaluating offtake deals, betting that 2026 will offer buyer-friendly pricing after four years of seller dominance.

In short, LNG’s next chapter looks stable but not serene — plentiful molecules, tighter margins, and a freight market that may stay busy even as profits flatten.

The post LNG Market Braces for 2026 Supply Surge — Prices May Have to Fall appeared first on The Logistic News.

Share this post

Related

Posts

The United States seizes a 7th tanker: pressure mounts on sanctioned ships

New episode in the maritime tug-of-war over sanctions: the United States has seized a seventh tanker suspected of operating in...

China replaces US barrels with Canada: new impact on tanker routes

The geography of oil is shifting, and shipping feels it immediately. According to analyzes reported by BIMCO, Chinese crude oil...

The Port of Klaipėda Signs a Record Year Driven by Containers, LNG, and Ro-Ro

The Lithuanian port of Klaipėda announces a historic performance in 2025: 39 million tons handled, despite a tense geopolitical context...

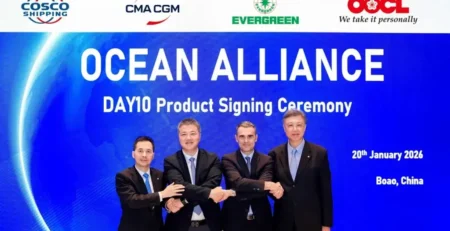

Ocean Alliance maintains the detour via the Cape, while preparing a “Suez plan”

The Ocean Alliance (CMA CGM, COSCO Shipping, Evergreen, and OOCL) has just unveiled its “Day 10” East-West network, which will...