Governments Race to Secure Critical Minerals

Copper, lithium, cobalt, rare earths. Names once familiar only to engineers are now being spoken in cabinet meetings and parliaments. This week, from Brussels to Washington to Tokyo, governments rushed to announce new deals and new stockpiles. The concern is the same everywhere: without secure access to critical minerals, the energy transition stalls.

In Europe, trade officials confirmed fresh talks with suppliers in Africa and South America. The target is bold—by 2030, at least 40 percent of Europe’s demand for key minerals should come from “trusted partners.” In the United States, the Department of Energy unveiled $600 million in funding for domestic refining projects, hoping to chip away at Chinese dominance. Japan, for its part, quietly expanded its rare earth stockpile program, a safety net for both electronics and defense industries.

The urgency is easy to explain. Global electric vehicle sales are on track to hit 20 million units in 2026, a figure that will double battery demand in less than two years. Grid-scale storage for wind and solar projects adds another layer of pressure.

For the logistics world, this is not just policy talk. It means new flows of bulk cargo, busier ports handling ore shipments, and more specialized containers moving refined chemicals. Forwarders say they are already mapping fresh routes through South American ports into Europe, while carriers in Asia are pushing for long-term contracts tied directly to mining projects.

And yet, the gap remains wide. Mines take years to develop. Refineries are concentrated in just a handful of countries. One European analyst put it bluntly: “Everyone wants resilience. Everyone is making promises. But the supply isn’t there yet, and the bottleneck will run straight through logistics.”

The post Governments Race to Secure Critical Minerals appeared first on The Logistic News.

Share this post

Related

Posts

The United States seizes a 7th tanker: pressure mounts on sanctioned ships

New episode in the maritime tug-of-war over sanctions: the United States has seized a seventh tanker suspected of operating in...

China replaces US barrels with Canada: new impact on tanker routes

The geography of oil is shifting, and shipping feels it immediately. According to analyzes reported by BIMCO, Chinese crude oil...

The Port of Klaipėda Signs a Record Year Driven by Containers, LNG, and Ro-Ro

The Lithuanian port of Klaipėda announces a historic performance in 2025: 39 million tons handled, despite a tense geopolitical context...

Ocean Alliance maintains the detour via the Cape, while preparing a “Suez plan”

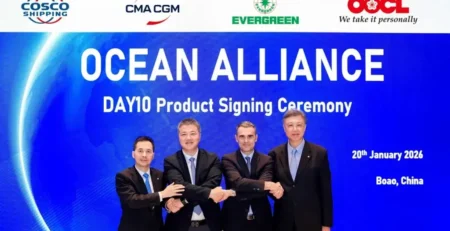

The Ocean Alliance (CMA CGM, COSCO Shipping, Evergreen, and OOCL) has just unveiled its “Day 10” East-West network, which will...