Asia–US Spot Rates Show a Fragile Rebound as Carriers Tighten Capacity

After nearly three months of rate erosion, the trans-Pacific container market has shown its first meaningful uptick. Freight indices out of Asia ticked higher last week, offering a short-lived breather to carriers still battling soft demand and excess capacity.

According to the latest Drewry World Container Index, spot rates from Shanghai to Los Angeles rose by roughly 6 percent week on week, while Shanghai to New York climbed about 4 percent. The gains follow a wave of blank sailings and ad-hoc vessel repositionings as carriers attempt to restore pricing discipline before the holiday slowdown.

A Pause in the Slide, Not a Turnaround

The rebound comes after a long downward drift that began in mid-August, when retail demand from the United States weakened and inventories remained high across major importers.

Analysts caution that this modest recovery does not mark the start of a sustained rally.

“It’s a tactical correction, not a structural one,” explained a senior rate analyst based in Singapore.

“Carriers have pulled enough tonnage to squeeze space temporarily, but the fundamentals are still soft.”

Behind the scenes, most shipping lines are quietly withdrawing low-yield sailings, especially on the US West Coast, where spot rates had fallen dangerously close to breakeven. The strategy is to protect what remains of profit margins through selective capacity control rather than broad-scale rate hikes.

Shippers Locking in November

Many US importers and freight forwarders are taking advantage of the brief price stability to secure November allocations before the next wave of rate volatility. Forwarders report that premium-service surcharges have reappeared on certain high-demand sailings to Los Angeles and Seattle, while East Coast bookings remain subdued.

For cargo owners, the message is mixed: now may be the best window to finalize year-end shipments, but no one expects sustained strength unless consumer spending improves through December.

Capacity Still Weighs on the Market

New tonnage continues to enter the global fleet. With delivery schedules still running heavy from earlier ship orders, global capacity is set to rise by more than 7 percent year on year, keeping pressure on rates well into 2026.

Even with dozens of blank sailings announced for November, analysts estimate that at least 20 percent of scheduled capacity remains underutilized across major Asia–US routes.

Outlook: A Cautious Calm

Freight forwarders describe the current moment as a “calm plateau” — a pause before either seasonal relief or another slide.

Much will depend on retail re-ordering patterns and US consumer confidence through Black Friday and the Christmas build-up. If spending falters again, carriers may have little choice but to roll out new rounds of rate cuts in early January.

For now, though, the market has caught its breath.

Carriers have stemmed the bleeding, shippers are booking space, and the ocean-freight chessboard feels momentarily balanced — if only until the next move.

The post Asia–US Spot Rates Show a Fragile Rebound as Carriers Tighten Capacity appeared first on The Logistic News.

Share this post

Related

Posts

The United States seizes a 7th tanker: pressure mounts on sanctioned ships

New episode in the maritime tug-of-war over sanctions: the United States has seized a seventh tanker suspected of operating in...

China replaces US barrels with Canada: new impact on tanker routes

The geography of oil is shifting, and shipping feels it immediately. According to analyzes reported by BIMCO, Chinese crude oil...

The Port of Klaipėda Signs a Record Year Driven by Containers, LNG, and Ro-Ro

The Lithuanian port of Klaipėda announces a historic performance in 2025: 39 million tons handled, despite a tense geopolitical context...

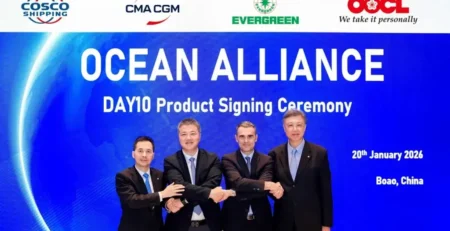

Ocean Alliance maintains the detour via the Cape, while preparing a “Suez plan”

The Ocean Alliance (CMA CGM, COSCO Shipping, Evergreen, and OOCL) has just unveiled its “Day 10” East-West network, which will...