Asia–Mexico Air Bridge Hits Record: E-commerce and Auto Parts Drive Demand

In the middle of the night at Mexico City’s airport, ground crews unloaded pallets of smartphones, fast fashion, and automotive spares from an incoming widebody jet. Flights like these have become routine, but the numbers now tell a bigger story: the Asia–Mexico air cargo bridge has reached record volumes this autumn.

The shift started slowly during the pandemic, when supply chains sought alternatives to U.S. gateways clogged with backlogs. Now, it’s a structural lane. Demand for electronics, textiles, and auto components has turned Mexico into one of Asia’s fastest-growing long-haul cargo partners. Forwarders describe flights landing “heavier than ever,” with load factors consistently above 90 percent.

Capacity has followed. Airlines based in Asia and Latin America have quietly added frequencies, some moving from three flights per week to daily rotations. Spot rates that once looked volatile have now stabilized at high levels, reflecting a lane that exporters and importers both treat as mission-critical.

Behind the growth are two pillars. First, Mexico’s automotive clusters—Monterrey, Puebla, Guanajuato—rely on just-in-time deliveries of precision parts. Second, the explosion of cross-border e-commerce is funneling parcels through Mexican hubs before they move north into the United States. Logistics managers say what used to be “overflow cargo” is now a fixed part of procurement planning.

For global shippers, the message is clear: Asia–Mexico is no longer a niche trade. It has matured into a corridor of its own, complete with predictable lift, regular schedules, and reliable pricing. The question for 2026 is not whether it grows, but how quickly.

The post Asia–Mexico Air Bridge Hits Record: E-commerce and Auto Parts Drive Demand appeared first on The Logistic News.

Share this post

Related

Posts

The United States seizes a 7th tanker: pressure mounts on sanctioned ships

New episode in the maritime tug-of-war over sanctions: the United States has seized a seventh tanker suspected of operating in...

China replaces US barrels with Canada: new impact on tanker routes

The geography of oil is shifting, and shipping feels it immediately. According to analyzes reported by BIMCO, Chinese crude oil...

The Port of Klaipėda Signs a Record Year Driven by Containers, LNG, and Ro-Ro

The Lithuanian port of Klaipėda announces a historic performance in 2025: 39 million tons handled, despite a tense geopolitical context...

Ocean Alliance maintains the detour via the Cape, while preparing a “Suez plan”

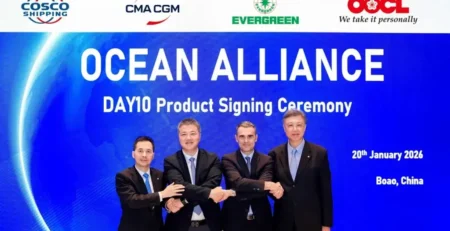

The Ocean Alliance (CMA CGM, COSCO Shipping, Evergreen, and OOCL) has just unveiled its “Day 10” East-West network, which will...