Giant overcapacity, shortage of small ships: the new two-speed container market

Behind the big numbers of a rapidly expanding global fleet lies a much more subtle imbalance. On one side, shipowners have a veritable army of mega-container ships, capable of carrying more than 20,000 TEUs on the major East-West routes. On the other hand, the market is facing a growing scarcity of small and medium-sized ships, essential for supplying regional lines, secondary ports, and more fragmented supply chains.

According to the analyzes reported by Seatrade Maritime, the gradual reopening of routes via the Red Sea will not be enough to correct this structural bias. The return of 6 to 8% of the world’s capacity currently diverted around Africa will certainly alleviate some congestion, but it will mainly add tonnage where it is already most abundant: on major intercontinental services. At the same time, nearly 9.5 million additional TEUs still need to be delivered by 2030, mainly in the form of large vessels.

Result: the market is moving toward a two-speed system.

• On major trades, competitive pressure and overcapacity are driving prices down.

• On secondary corridors – intra-regional in Asia, the Mediterranean, the Gulf, or on certain North-South routes – the shortage of suitable vessels maintains sustained pressure on rates.

For medium-sized ports and shippers located outside major hubs, this imbalance translates into less frequent services, more irregular transit times, and sometimes higher costs compared to major East-West routes.

From the perspective of the energy transition, this paradox also complicates matters: the latest generation of mega-ships are often equipped with more energy-efficient technologies, while many smaller units, tho essential to regional logistics chains, remain less advanced in terms of decarbonization. The investment choices of shipowners in the next five years – new “mid-size” ships, retrofits, service pooling – will be crucial in rebalancing the system.

For the members of The Logistic News, the challenge is clear: they will need to refine the routing strategy, combine major deep-sea services with innovative regional solutions (feedering, cabotage, multimodal), and rely on solid local partnerships to secure access to secondary ports in a market that has become asymmetrical.

The post Giant overcapacity, shortage of small ships: the new two-speed container market appeared first on The Logistic News.

Share this post

Related

Posts

The United States seizes a 7th tanker: pressure mounts on sanctioned ships

New episode in the maritime tug-of-war over sanctions: the United States has seized a seventh tanker suspected of operating in...

China replaces US barrels with Canada: new impact on tanker routes

The geography of oil is shifting, and shipping feels it immediately. According to analyzes reported by BIMCO, Chinese crude oil...

The Port of Klaipėda Signs a Record Year Driven by Containers, LNG, and Ro-Ro

The Lithuanian port of Klaipėda announces a historic performance in 2025: 39 million tons handled, despite a tense geopolitical context...

Ocean Alliance maintains the detour via the Cape, while preparing a “Suez plan”

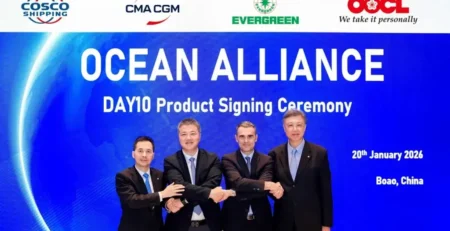

The Ocean Alliance (CMA CGM, COSCO Shipping, Evergreen, and OOCL) has just unveiled its “Day 10” East-West network, which will...