India Moves to Protect Its Steelmakers with Five-Year Tariff on Vietnamese Imports

India has decided to draw a line in the sand for its steel industry.

After months of complaints from local mills about underpriced shipments from Vietnam, New Delhi has imposed a five-year anti-dumping duty on several grades of cold-rolled and galvanized steel used in cars, appliances, and construction.

The measure, announced by the Directorate General of Trade Remedies, will remain in force until 2030 unless a new review changes the rate. Officials say the decision was taken after investigators confirmed that imports from Vietnam were landing in India below cost, pushing domestic prices down and squeezing mill margins.

“We’re not shutting out trade,” one senior official said in Delhi. “We’re restoring balance to a market that had tilted too far.”

The timing reflects a delicate moment for India’s industrial policy.

Domestic steelmakers—many of whom borrowed heavily during the last capacity expansion—have struggled with rising energy prices and slower demand from real estate and infrastructure projects. By imposing duties now, the government is trying to shore up profitability without igniting inflation.

Analysts estimate that the move could lift domestic steel prices by around 4 percent over the next quarter, modest enough to protect producers while limiting fallout for end users. Automotive and construction firms, however, warn that higher costs could feed into project delays or smaller margins on export contracts.

Importers are already seeking alternative suppliers in Japan, South Korea, and the Middle East, which could alter established shipping routes along India’s west coast. For freight forwarders and ports, that means a shift in cargo origin points rather than an outright drop in tonnage.

The decision is part of a broader trend: India has quietly become more assertive in defending its industrial base, with similar measures recently applied to aluminum from China and stainless steel from Malaysia. Policymakers see it as a test of resilience—how to stay open to global trade while protecting the foundations of domestic manufacturing.

In a global market where price wars often decide survival, India is signaling that fairness, not volume, will set the terms of its next growth phase.

The post India Moves to Protect Its Steelmakers with Five-Year Tariff on Vietnamese Imports appeared first on The Logistic News.

Share this post

Related

Posts

The United States seizes a 7th tanker: pressure mounts on sanctioned ships

New episode in the maritime tug-of-war over sanctions: the United States has seized a seventh tanker suspected of operating in...

China replaces US barrels with Canada: new impact on tanker routes

The geography of oil is shifting, and shipping feels it immediately. According to analyzes reported by BIMCO, Chinese crude oil...

The Port of Klaipėda Signs a Record Year Driven by Containers, LNG, and Ro-Ro

The Lithuanian port of Klaipėda announces a historic performance in 2025: 39 million tons handled, despite a tense geopolitical context...

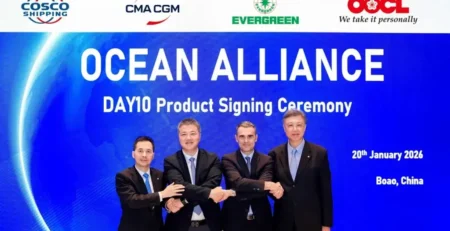

Ocean Alliance maintains the detour via the Cape, while preparing a “Suez plan”

The Ocean Alliance (CMA CGM, COSCO Shipping, Evergreen, and OOCL) has just unveiled its “Day 10” East-West network, which will...