Major Shake-Up in E-Commerce Supply Chains as U.S. Revokes De Minimis Privileges

By Maria Kalamatas | The Logistic News | April 1, 2025

The logistics sector is facing a new wave of uncertainty following the U.S. government’s decision to suspend de minimis exemptions for shipments arriving from China, Canada, and Mexico. The move, announced in February and set to take full effect in the coming weeks, has disrupted established trade patterns and sparked concern across the e-commerce and freight forwarding industries.

The de minimis rule, long viewed as a cornerstone of streamlined international shipping, allowed goods valued at $800 or less to enter the U.S. without incurring tariffs or extensive customs procedures. For years, this exemption has served as a vital enabler for low-cost cross-border transactions, particularly in the fast-growing e-commerce sector. Its suspension signals a major policy shift and is already sending shockwaves across global supply chains.

E-Commerce Giants Under Pressure

Companies like Shein, Temu, and other direct-to-consumer brands that rely on China-based fulfillment are now scrambling to adapt. Previously able to ship low-value orders directly to American customers with minimal delay or duty, these businesses now face not only higher costs but added regulatory friction. Some have begun rerouting shipments through third countries or investing in domestic warehousing to avoid delays.

Temu, in particular, has responded swiftly, emphasizing U.S.-based inventory in its app and promotional campaigns in an effort to reassure customers of faster, tariff-free deliveries. However, supply chain analysts caution that such pivots may not be sustainable at scale and could pressure already thin margins.

U.S. Retailers Caught in the Crossfire

The fallout isn’t limited to foreign sellers. A growing number of U.S.-based e-commerce startups and importers that source inexpensive goods from Canada or Mexico are now also subject to full customs declarations and duties. According to the National Customs Brokers & Forwarders Association, many smaller retailers were caught off guard, assuming trade agreements like the USMCA would shield them from these new measures.

“Many companies structured their supply chains around the de minimis rule,” said Carla Jefferson, a customs compliance consultant based in Chicago. “Now, they’re scrambling to redesign their import strategies practically overnight.”

Impact on Freight Forwarders and Brokers

Freight forwarders and customs brokers are experiencing an unexpected surge in small shipment processing needs. With more packages requiring formal customs clearance, workloads have spiked—especially at ports like Los Angeles, Miami, and Newark. This sudden influx is also slowing clearance times, increasing transit costs, and creating operational headaches.

“There’s a domino effect happening,” said Samir Rafiq, Managing Director of Global AirTrade Logistics. “Customs needs more time, brokers need more manpower, and importers are frustrated with the delays and added fees. It’s a logistical mess.”

Supply Chain Realignment in Motion

Some importers are exploring reshoring and nearshoring solutions to mitigate exposure to unpredictable trade policy. Mexico, despite being affected by the policy change, remains a preferred alternative to China due to geographic proximity and shorter delivery windows. Others are eyeing Southeast Asian suppliers with more favorable duty structures.

Meanwhile, large logistics providers are updating their advisory services to help clients understand the shifting landscape. UPS, DHL, and FedEx have all released statements acknowledging the changes and promising tailored support to affected businesses.

A Policy with Economic and Political Weight

While the U.S. Trade Representative argues that the suspension aims to curb unfair trade practices and bolster domestic manufacturing, critics say the approach is too blunt. “You’re hurting the same small businesses you claim to support,” noted Angela Wu, Director at the Global Logistics Policy Council. “Compliance burdens are increasing at a time when e-commerce and supply chains are already strained.”

Economists warn that consumers may also feel the effects through higher prices and longer delivery times, particularly for fast-moving consumer goods.

Looking Ahead

As industry stakeholders await potential legal challenges or trade negotiations that might reverse or revise the policy, many are opting for contingency planning. With the global logistics landscape in flux, agility and transparency are becoming more crucial than ever.

“This is a moment of reckoning for global e-commerce,” concluded Jefferson. “The rules have changed, and only those with adaptive supply chains will thrive in the next chapter.”

Maria Kalamatas

Senior Correspondent, The Logistic News

Published: April 1, 2025

The post Major Shake-Up in E-Commerce Supply Chains as U.S. Revokes De Minimis Privileges appeared first on The Logistic News.

Share this post

Related

Posts

The United States seizes a 7th tanker: pressure mounts on sanctioned ships

New episode in the maritime tug-of-war over sanctions: the United States has seized a seventh tanker suspected of operating in...

China replaces US barrels with Canada: new impact on tanker routes

The geography of oil is shifting, and shipping feels it immediately. According to analyzes reported by BIMCO, Chinese crude oil...

The Port of Klaipėda Signs a Record Year Driven by Containers, LNG, and Ro-Ro

The Lithuanian port of Klaipėda announces a historic performance in 2025: 39 million tons handled, despite a tense geopolitical context...

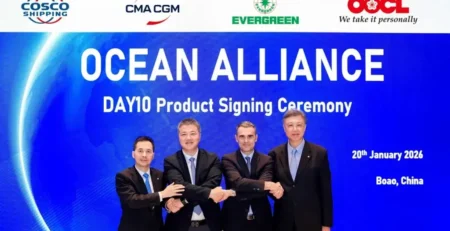

Ocean Alliance maintains the detour via the Cape, while preparing a “Suez plan”

The Ocean Alliance (CMA CGM, COSCO Shipping, Evergreen, and OOCL) has just unveiled its “Day 10” East-West network, which will...